How ESG Investing Fits Into Your Halal Portfolio

Social inequality, abject poverty, poor labor conditions, bad leadership, and climate change are some of the issues plaguing society. Investors are becoming increasingly conscious of these challenges and are aware of the influence that their investments may have, both positive and negative. Unsurprisingly, investors are looking for approaches that are not merely profitable but also good for the environment and people. This is where ESG investing has proven to be beneficial.

What is ESG?

ESG stands for Environmental, Social, and Governance. ESG investing grew out of investment philosophies such as Socially Responsible Investing. However, ESG investing takes it a step further and instead of merely using a value-based system to negatively screen (actively avoid) investments, ESG investing looks at finding value in companies. The environmental component considers issues such as pollution, energy efficiency, and waste management. The social component considers issues such as customer satisfaction, data protection, and diversity. Finally, governance looks at matters related to audit committee structure, bribery, and corruption. ESG investing aims to find well-rounded companies that will not only provide sustainable returns but will also help benefit the environment.

How have ESG funds performed?

ESG funds have often outperformed their conventional counterparts. S&P Global Market Intelligence analyzed 26 ESG exchange-traded funds and mutual funds, and from 5th March 2020 to 5th March 2021, 19 of those funds performed better than the S&P 500. Similarly, a prior review by S&P Global Market Intelligence of a smaller set of 17 ESG funds in August 2020 found that all but three had outperformed the S&P 500 in the year to date.

A study by Henisz found that ESG investing resulted in superior returns mainly due to the following five links:

- Facilitating top-line growth - Top-line growth is an increase in revenue of a company over a period of time. ESG proposition helps companies tap into new markets and expand into existing ones as ESG considerations can drive consumer preferences.

- Reducing costs - Executing ESG can combat rising operational expenses in a company. This can occur by reducing energy consumption, recycling, and reusing waste.

- Minimizing regulatory and legal interventions - ESG assists companies as it tends to reduce government pressure. It may also be a cause of being awarded (or rejected) from government subsidies.

- Increasing employee productivity - A powerful ESG proposition can increase productivity, drive a sense of purpose, and grow employee motivation. Additionally, employee satisfaction is positively correlated with shareholder returns.

- Optimizing investment and capital expenditures - The two most prominent ways this may occur in a company is that capital allocation will be towards sustainable projects while avoiding projects which may not be sustainable in the long term due to environmental or changing societal patterns.

How to ensure an investment meets ESG criteria

There are many ways to incorporate ESG strategies into a portfolio. An investor in a company can consider a company’s ESG profile as one of the factors to evaluate when considering whether to buy a stock. Another way is to make use of shareholder activism. As a shareholder in a company, you may have certain rights within that company, such as voting rights, which can allow you to bring about change in the way a company is run.

Unfortunately, there is no universally accepted methodology to determine the ESG rating of a particular stock. However, here are four broad methods or tools that you can use to determine the ESG rating of an investment:

1. Use an agency

Many reputable research agencies provide ESG benchmarks or scores. An investor may simply find an appropriate agency and use its ESG scores to guide their investment decisions. Some of the more accessible and reputable examples are:

These agencies may also rate mutual funds, ETFs, and even countries. Some investment funds also include their criteria to determine their ESG investment methodology.

2. Independent evaluation

This is when an individual investor independently researches a company and develops their own ESG screen. This is a complex method and requires the most experience. However, it is also the most flexible. Investors can tailor the criteria to their specific needs and include aspects that mainstream agencies may have overlooked.

3. Hybrid

This is a combination of independent research and using one of the above-mentioned tools to establish your own ESG criteria. Another common hybrid approach is to use the Ten Principles of the UN Global Compact as a basis for your ESG criteria and then build upon that.

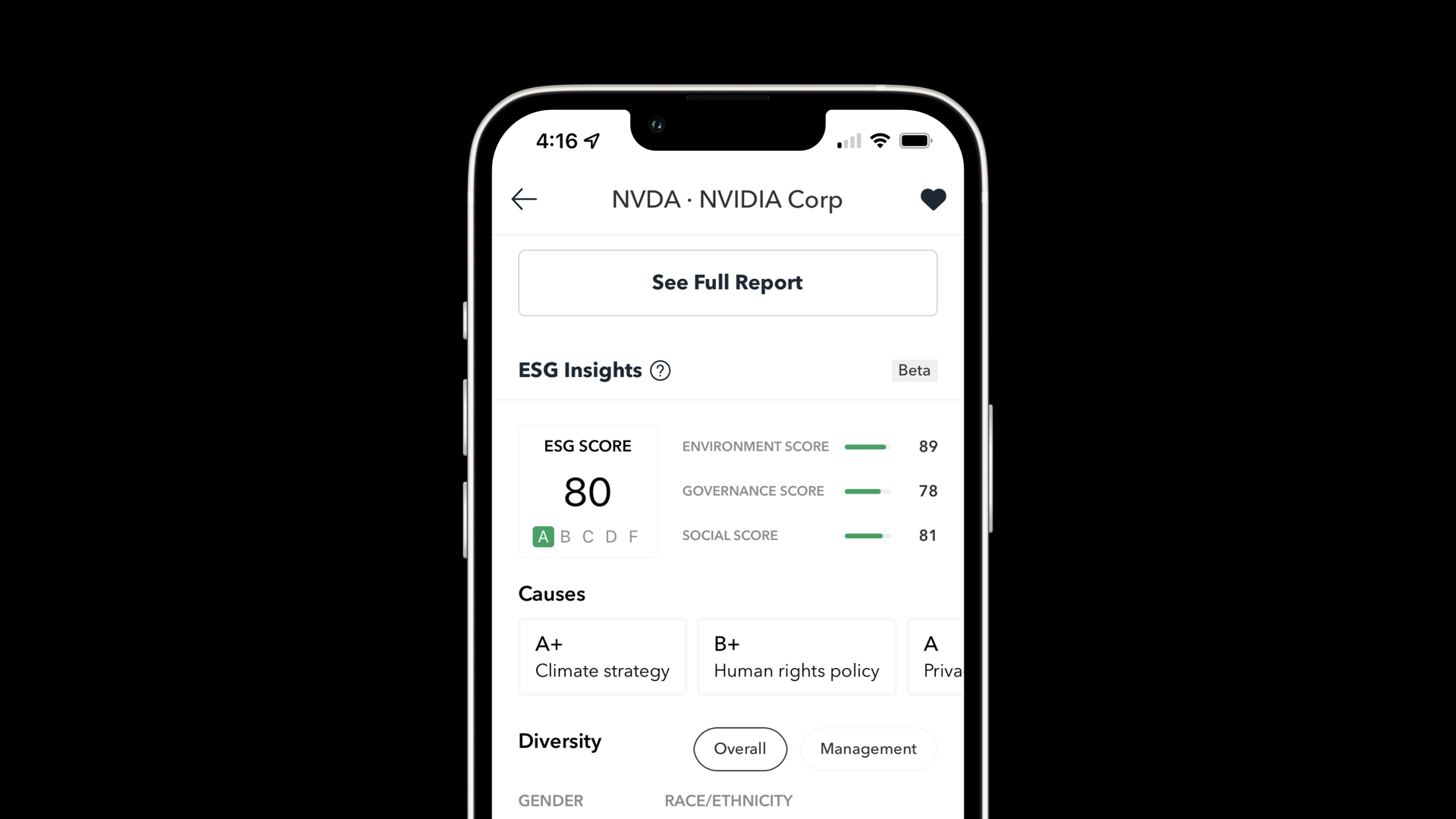

4. Zoya’s built-in ESG screener

Zoya provides ESG data for most of the S&P 500 companies. If you're a Zoya Pro subscriber, you can access this data on the stock detail screen just below the shariah compliance status (see this FAQ for more info). Alternatively, you can also use Zoya's fund screener to find ESG funds and invest in their shariah-compliant holdings. For example, check out fund tickers ESG, NULC, and QQMG as a start.

Zoya: Halal Stocks, ETFs, Mutual Funds

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.

Shariah-compliant investing vs ESG investing

There are many similarities between ESG and shariah-compliant investing. Both are motivated by principles of morality, fairness, and justice without compromising profits. Both are guided by an investment philosophy that seeks to avoid harming people and the environment. ESG investments, like shariah-compliant investments, avoid certain activities, products, and industries so that an investment is aligned with an investor's values. For example, an ESG investor, as well as a shariah-compliant investor may avoid industries such as alcohol, gambling, defense, and tobacco.

However, there are distinctions between ESG investing and shariah-compliant investing. At its core, an ESG investor will evaluate an investment based on whether it creates a positive environmental, social and corporate governance impact. The core consideration of a shariah-compliant investor is whether an investment is halal or not. For example, a wind farm with good social and governance practices may not meet the requirements of a shariah-compliant investor if it has high debt levels because riba (interest) is prohibited in Islam. Therefore, while there is a strong overlap between ESG investing and shariah-compliant investing, the two aren’t always the same.

How Shariah-compliant investing is better than modern-day ESG investing

The term maqsid (plural: maqasid) refers to an objective or purpose. Maqasid of the shariah are the objectives of the shariah. Many Islamic scholars have seen this as an alternate expression of humanity’s interest, and Abd al-Malik al-Juwayni used maqasid and public interests interchangeably. Al-Qarafi linked benefit and maqasid by a fundamental rule that stated: A purpose is not valid unless it leads to the fulfillment of some good or the avoidance of some harm. Therefore, a maqsid, in Islamic law, is for the interest of humanity.

Traditional classifications of maqasid divide them into levels of necessity. Necessities are further classified into the preservation of:

- Faith

- Soul

- Wealth

- Mind

- Offspring

If health and the environment aren’t taken care of, human life will be jeopardized, resulting in the dereliction of the need to protect the soul. Unsurprisingly, the Prophet (PBUH) prohibited all harm of any form to another human being, animals, or even plants. In a financial crisis, human life is also in danger, which is why Islam bans monopoly, usury, and all forms of corruption and fraud.

A dive into the objectives of the shariah makes it clear that it undoubtedly addresses environmental, social, and corporate governance concerns through its guidelines, even if it’s not always apparent. Despite the shariah predating ESG investing, it is far superior to the contemporary iterations of ESG investing. Here are two ways shariah-compliant investing is better than modern-day ESG investing:

- It considers potential benefits in the hereafter and not merely transient benefits.

- It’s based on Divine law. Any system based on the Perfect law of the Legislator is bound to be superior to laws developed by man.

Many scholars and organizations have attempted to codify the rules surrounding investments. However, it should be noted that the understanding and implementation of any investment rule is left to human beings who are bound to err. Therefore, scholars are continuously trying to improve and looking for better ways to codify, streamline and facilitate the implementation of these laws.

The standards developed by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) are the gold standard for determining whether an investment is halal or not. Many institutions and products, such as Zoya, utilize these standards as the basis of their screening methodology. This has significantly simplified the process of screening investments and has been immensely beneficial in making halal investing more accessible for Muslims globally.

A new paradigm

Muslims have a strong and established tradition that can add immense value to the investment landscape. It’s time to adopt a new paradigm – instead of viewing shariah-compliant investments as an impediment, it is time to view it as it should be: the salvation of humanity.